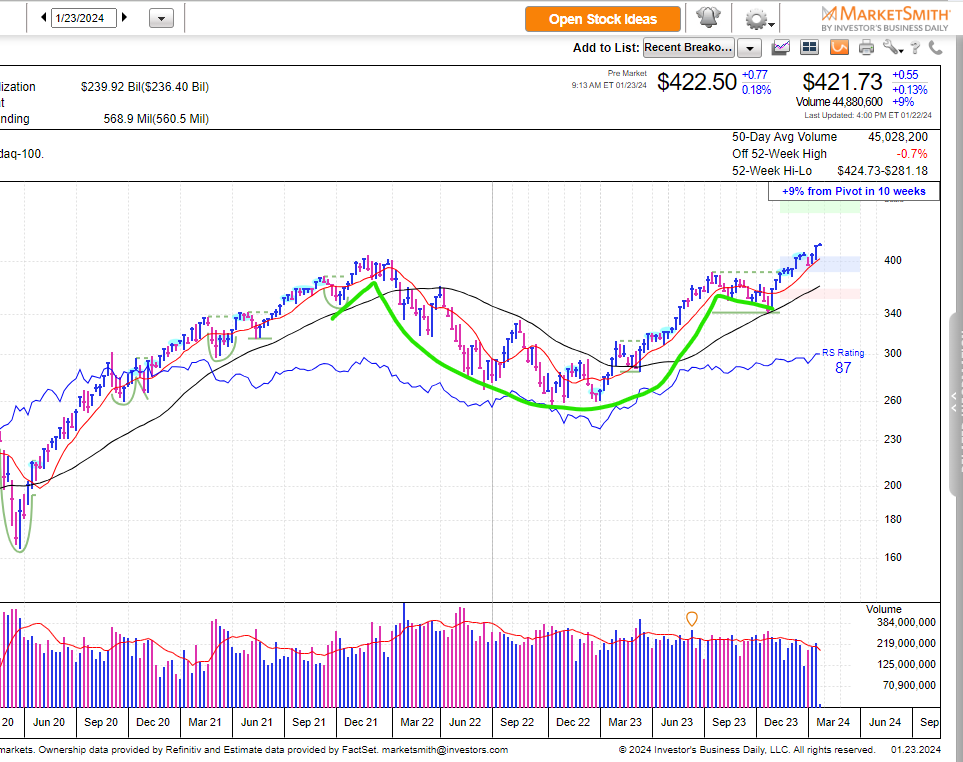

Looking at the QQQ on a weekly chart.

After three strong trading days, it’s easy to forget how many of us were nervous last Wednesday when the Nasdaq 100 (QQQ) fell two days in a row. On the Last Week in the Market podcast, Adam Sarhan said that some of his coaching clients contacted him, distressed that that pullback had triggered some of their protective sell stops. Adam reminded his clients that a drawdown is part of healthy market action, and to put it all into perspective, he showed them that the QQQ only briefly dipped below the 21-day average and found support well above the 50-day moving average. That’s very bullish.

Stepping Back

Sometimes, it pays to take a step back and look at things from a broader perspective – especially when there is volatile intraweek trading. If you set your stock charting software to weekly and set the range to three years, you’ll see that the Qs have experienced only one down week out of the last 12. You’ll also see that from as far back as the summer of 2021, the QQQ has formed a beautiful cup and handle pattern. It broke out of the handle back in November of 2023, and it only looked back once. On the monthly chart, it’s an even prettier sight and shows we haven’t had one down month since October. (For those new to technical trading, a cup and handle pattern often – but not always – signals a possible move upwards.)

The QQQ makes a cup and handle pattern on the weekly chart:

Charts & Data Courtesy MarketSmith Inc. Click Here To Join MarketSmith.

Market Conditions

The “M” in the A.M.P.D. trading strategy stands for “Market Conditions.” When we spend too much time obsessing over the daily charts – especially during a volatile week – we can forget to stand back and see the broader strength (or weakness) of the market.

The A.M.P.D. trading strategy is for self-guided, independent traders. This article is for informational and educational purposes only. This is not financial advice. Trading is risky, and you alone are responsible for all your trading decisions.